EE Savings Bonds

You can create your own annuity or guaranteed income by purchasing EE series savings bonds. I stumbled upon this idea a couple of years ago and the concept is quite simple. Start purchasing EE series bonds every year starting 20 years before you need the income and your investment will exactly double after 20 years!

How it Works (The Math)

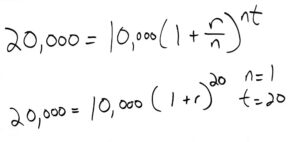

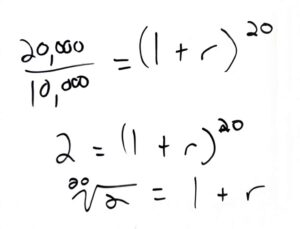

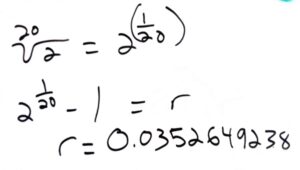

EE Series Savings Bonds currently don’t offer much yield on an annual basis. The current rate is only 0.10% but the magic happens because the U.S. Treasury guarantees the face value of your EE savings bond will double in 20 years. The math behind this works out to an annual interest rate of roughly 3.52% interest. To derive this number yourself view the example outlined below using a $10,000 principal which doubles to $20,000 in 20 years, or you can derive it yourself in a spreadsheet.

Decide How Much to Invest

The maximum you can invest per year in EE series savings bonds is $10,000 per individual. If you have a spouse you can each invest up to $10,000 per year for a total of $20,000 combined. This means the maximum guaranteed income you can produce using this method would be $40,000 if both you and your spouse invested the full amount each year. Likewise if only 1 individual invested the full amount then $20,000 is the maximum income this would produce.

The Ladder Concept

Creating a fixed income ladder is often used to describe methods to achieve similar results as what we are discussing here. The idea is to purchase individual bonds or CD’s of various yields that mature on different dates or years in order to provide income throughout your desired timeline. You can easily do more research on this topic by searching for “create a bond ladder” or “create a CD ladder”.

Utilizing EE savings bonds is no different than any other ladder but the timeline is a bit longer. Starting 20 years from when you need the income start buying EE savings bonds so they will double in those 20 years. For example if you want to retire at age 60 you would begin buying EE savings bonds at age 40 and then you would keep buying them each year until you wanted the income to stop. If you stopped buying at age 60 then you will have guaranteed yourself income through age 80 for example.

The income isn’t guaranteed for life but we aren’t paying a premium for that guarantee either like some annuities. You can create a custom plan to give yourself income for a few years until social security kicks in or you can plan to give yourself income until age 95. It’s completely customizable and you retain full control over the funds if you ever need the money or your situation changes. This is unlike some annuities that would charge hefty surrender fees or have expensive rider clauses.

20 Years is a Long Time

I think the biggest risk to this idea is having to wait 20 years to get the 3.52% yield. If you decide to sell some bonds after 10 years you will have only been earning 0.10% per year which is terrible! Currently 20 year treasuries are yielding slightly lower than 3.52% but they were yielding slightly higher for a time back in June 2022 so that’s something to keep an eye on. Shorter duration treasuries, bonds, and CD’s were all yielding at or above 3% recently as well.

I bonds are also currently yielding much higher than 3.52% so I would definitely be maxing those out first before venturing into EE savings bonds.

Summary

The idea of creating your own annuity or guaranteed amount of fixed income is certainly appealing but not without risk in this case. I’ve got a couple years before I will turn 40 so I will probably start purchasing small amounts of EE savings bonds and start my own ladder around that time. The idea of providing some stop gap income until social security starts is very appealing and this could be a great way to achieve that.

At the very least I don’t believe enough people know about series EE savings bonds and how they can be used to supplement your retirement income. It’s an idea worth sharing and these EE savings bonds can help create a safe and steady floor of fixed income in early retirement or throughout retirement.